Back

Generative AI Use Cases in Manufacturing Vs. Banking: 2024 Trends

While banking explores generative AI in 2024, manufacturing is already seeing transformative results. Compare generative AI use cases in manufacturing versus banking and discover why manufacturing AI platforms are delivering superior ROI across industries.

In the last few years, the use of Generative AI in banking has seen remarkable growth.

Before 2020, only 5% of financial institutions had begun exploring its potential.

Fast forward to 2022, and the adoption rate has skyrocketed nearly fourfold, according to a Cornerstone Advisors study.

“You essentially have the knowledge of the most knowledgeable person in Wealth Management—instantly. We believe that is a transformative capability for our company, “Jeff McMillan, Head of Analytics, Data & Innovation at Morgan Stanley Wealth Management, said.

“You essentially have the knowledge of the most knowledgeable person in Wealth Management—instantly. We believe that is a transformative capability for our company, “Jeff McMillan, Head of Analytics, Data & Innovation at Morgan Stanley Wealth Management, said.

The consumer perspective: Embracing AI in banking

Customers are not just warming up to Generative AI; they’re actively engaging with it. A significant majority have interacted with AI-powered services at least once, and their feedback is overwhelmingly positive. This enthusiasm from customers underscores the effectiveness of Generative AI in enhancing the banking experience, making services more accessible, and responses quicker. As an example, Bank of America’s Erica leverages AI to provide personalized financial advice, showcasing the potential of digital assistants in banking. By analyzing users’ financial behaviors, Erica offers insights and recommendations, elevating the standard for digital banking services. The use cases for Generative AI in banking stretch far beyond consumer-facing applications. Banks and financial institutions are experimenting with this technology to navigate regulatory compliance, quickly access important information and identify fraud.Regulatory compliance

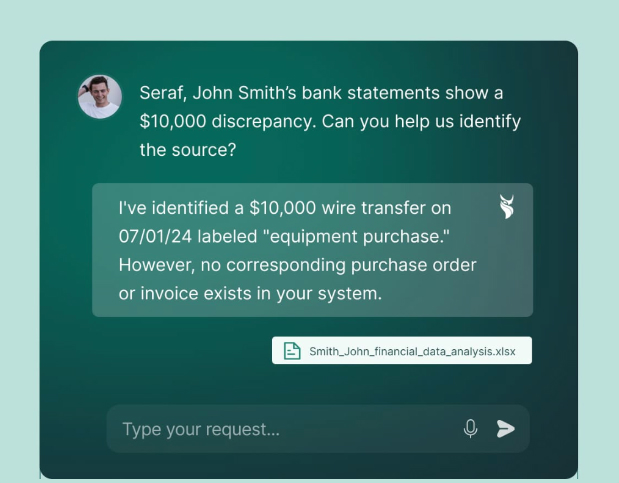

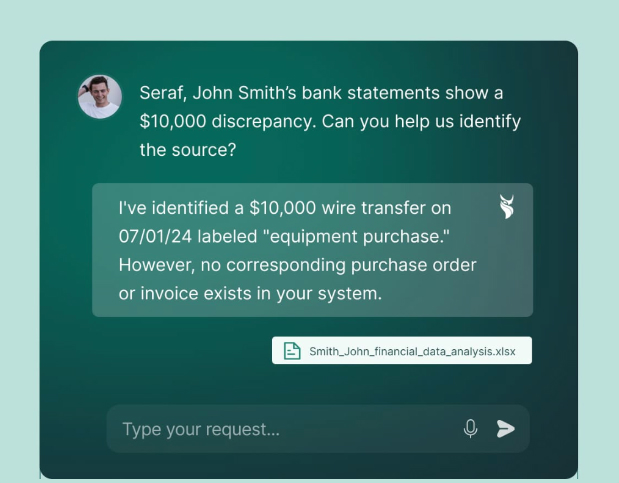

When federal regulators introduced 1,089 pages of new capital regulations to the US banking sector, Citigroup meticulously analyzed the document using generative AI. The bank’s risk and compliance department employed this technology to evaluate how these rules would affect the bank’s capital reserves required for loss protection. Through generative AI, the complex proposal was broken down into manageable sections, and essential insights were generated. These findings were then shared with the bank’s outgoing treasurer, Mike Verdeschi.Fraud prevention

Generative AI enhances chatbots’ ability to learn from previous incidents of fraud and to keep an eye on transactional activities for any signs of fraudulent behavior. When it detects something out of the ordinary, it swiftly notifies customers. Here are ways in which Generative AI can spot fraud:- It observes user actions, including their location, the devices they use, and their operating systems.

- It enforces extra layers of verification like security queries and password checks.

- It examines established transaction patterns and looks out for any unusual changes.

Information retrieval

Morgan Stanley, a leader in wealth management, is empowering an internal chatbot with OpenAI’s GPT-4. The chatbot will perform a comprehensive search of the wealth management content and unlock the cumulative knowledge of Morgan Stanley Wealth Management. Previously, finding specific information within the knowledge library was time-consuming and difficult for advisors as the information was spread across many internal sites and mostly in PDF form. This initiative is expected to make the information more usable and actionable for the company. “You essentially have the knowledge of the most knowledgeable person in Wealth Management—instantly. We believe that is a transformative capability for our company, “Jeff McMillan, Head of Analytics, Data & Innovation at Morgan Stanley Wealth Management, said.

“You essentially have the knowledge of the most knowledgeable person in Wealth Management—instantly. We believe that is a transformative capability for our company, “Jeff McMillan, Head of Analytics, Data & Innovation at Morgan Stanley Wealth Management, said.